We do not have a published minimum credit score, however, if you are putting down less than 20%, and are not using the va loan program, the minimum credit score is typically 620. However, you can still save money on your taxes through various deductions.

Low Income Mortgage Loans For 2021

We offer low downpayment requirements, down payment assistance (up to 4% cash to help.

First time home buyer nh bad credit. You will also need to. A bad credit score falls somewhere between 300 and 579 on the fico credit scoring scale. Must put 10% down, but still eligible.

What is your minimum credit score? Your credit score is just one of the many factors that mortgage lenders scrutinize when determining whether youre eligible for a home loan. Because people with lower credit scores may qualify for an fha loan, they are sometimes referred to as bad credit loans.

The program ended in 2010. (4) all borrowers have a credit score of 680 or better on 2 out of 3 credit bureaus. Find out more on the kinga ora website.

Up to $80,000 in down payment, plus up to $4,000 in closing cost assistance. Many people who can afford the monthly mortgage payments and have reasonable credit will qualify. (5) home is not listed for sale.

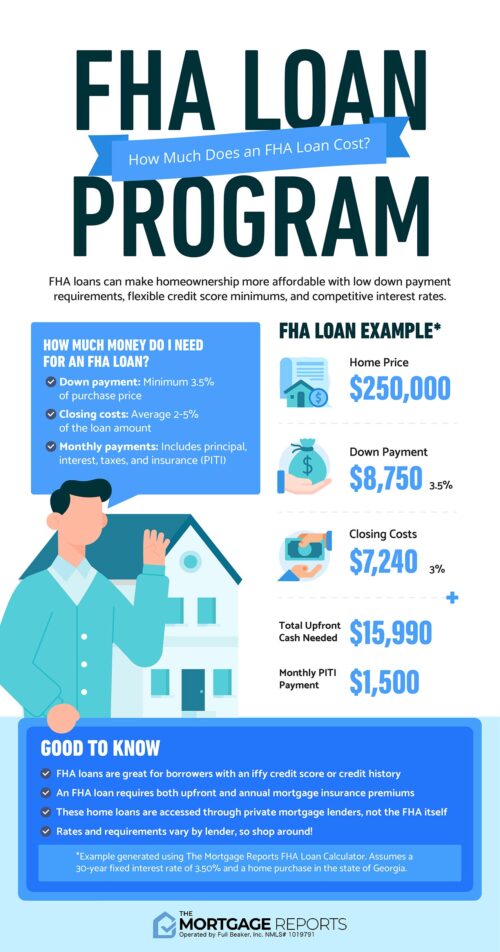

The federal housing administration allows down payments as low as 3.5% for those with credit scores of 580 or. But that number could drop closer to fhas published minimums because of the new policy. However, your income cannot exceed 100% of the area median income.

A minimum credit score of 620 is needed with a 3% down payment. Inland revenue has more information about: Do you do loans outside of nh/me/vt/ma?

Fha loans are an ideal option for bad credit home loans because they require only a 3.5% down payment and a minimum credit score of 640. Eligible for 3.5% down payment. The following are some of the criteria that households must meet to be eligible for the one mortgage program.

Not eligible for fha financing. While the specific programs may have different income limits, in general, we serve borrowers with incomes up to $137,400. In order to qualify, buyers need to obtain a mortgage.

Home purchase assistance program (hpap) type: (2) loan amount is $100,000.00 or greater. For example, buyers can qualify for an fha loan with 3.5% down, or.

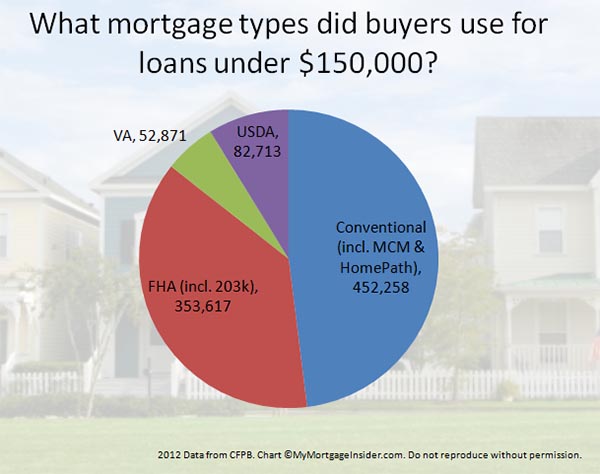

How much to leave in your kiwisaver account; Fha loans are the #1 loan type in america. It depends on many variables, including the down payment amount, loan program, and property type.

Down payment assistance may be available in your area. A $200,000 home could require annual mortgage insurance ranging from $600 to $3,000. You can apply to withdraw your kiwisaver savings to put towards buying your first home if you have belonged to your kiwisaver scheme for at least 3 years.

Credit score at or above 580: New hampshire housing offers a number of different homeownership programs to help make homeownership more affordable.

First-time Home Buyer Guide 2021 Programs Grants Faq

Tips For First Time Homebuyers How To Pay Your Property Taxes

Home Buyer Tax Credit In Nh

Low Income Mortgage Loans For 2021

Down Payment Assistance Programs In Every State 2021

Buying Your First Home Can No Doubt Be An Overwhelming Task But This Article Helps To Set Up A Fe First Time Home Buyers Buying First Home Home Buying Process

Nh Home Buyer Tax Credit Home Start Homebuyer Tax Credit Hanover Nh Real Estate Lebanon Nh Real Estate Upper Valley Homes

Fha Loan Calculator Check Your Fha Mortgage Payment

Bad Credit Fha Loans - Fha Lenders

New Hampshire First Time Home Buyer Programs

7 Reasons A First Time Home Buyer In Nh Should Consider A Condo

The New Rules For Buying A House In 2021 Money

First Time Homebuyer Grants And Programs Nextadvisor With Time

First Time Sedona Home Buyers - Sedona Real Estate

First-time Homebuyer Programs In New Hampshire - Newhomesource

What Is The First-time Home Buyer Credit And Will It Ever Come Back Forbes Advisor

First Time Home Buyer Programs In All 50 States Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Bad Credit Home Loans Michigan First Time Home Buyer Loans 2018

The Essential Guide For First Time Home Buyers In Ct

First Time Home Buyer Nh Bad Credit. There are any First Time Home Buyer Nh Bad Credit in here.